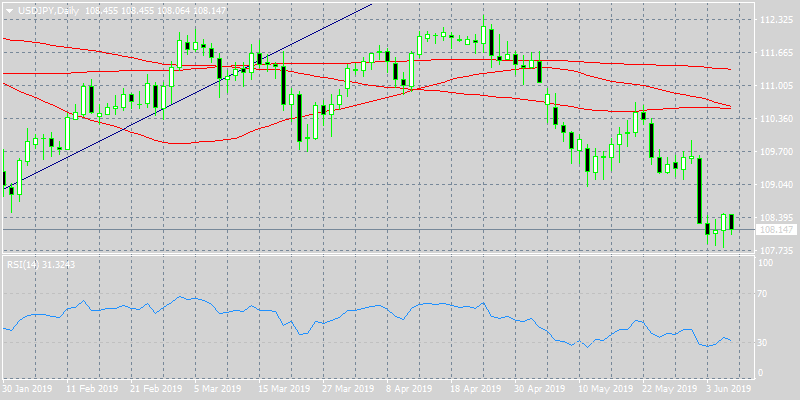

Yen started the European trading session on strong foot today, after the pair yesterday hit the weekly high at 108.50....

Job Title:

Forex Analyst

Home Location:

London, United Kingdom

Education:

Finance at Golden Gate University

Expertise:

Technical Analysis · forex · Stocks · Crypto · Writing

Knows About:

Technical Analysis · forex · Stocks · Crypto · Writing

Summary:

Technical analyst of forex, stock market indices and commoditiesTechnical analyst of forex, stock market indices and commodities

PositionForex Analyst

JoinedOct 07, 2021, 13:51 BST

Articles2470

Technical analyst of forex, stock market indices and commoditiesTechnical analyst of forex, stock market indices and commodities

Skills: Technical Analysis · forex · Stocks · Crypto · Writing

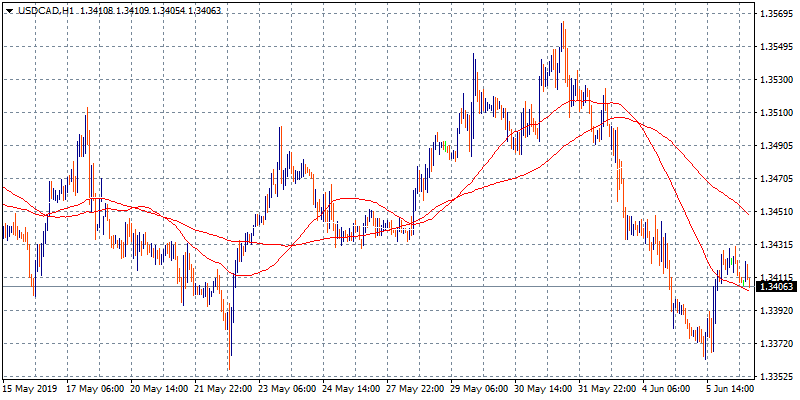

The pair rebounds today breaking above the 1.34 level and trading as of writing at 1.3416 amid USD strength across...

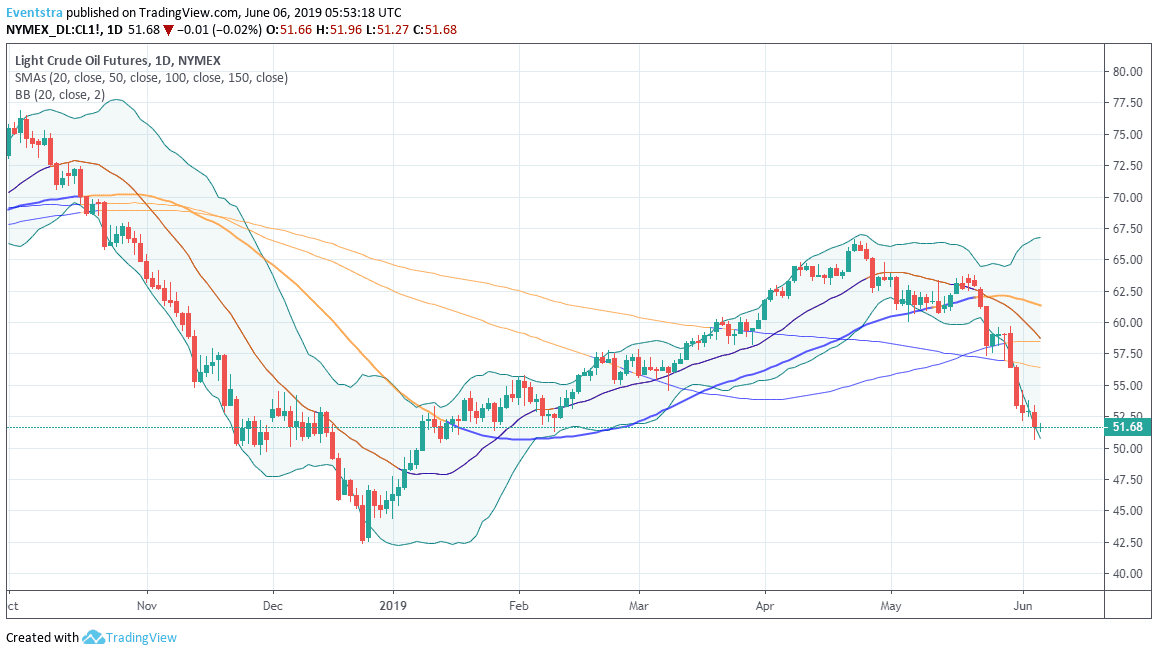

Crude oil finished lower for one more day down to 51.73 losing $1.23 (-2.30%) a level that we haven’t seen...

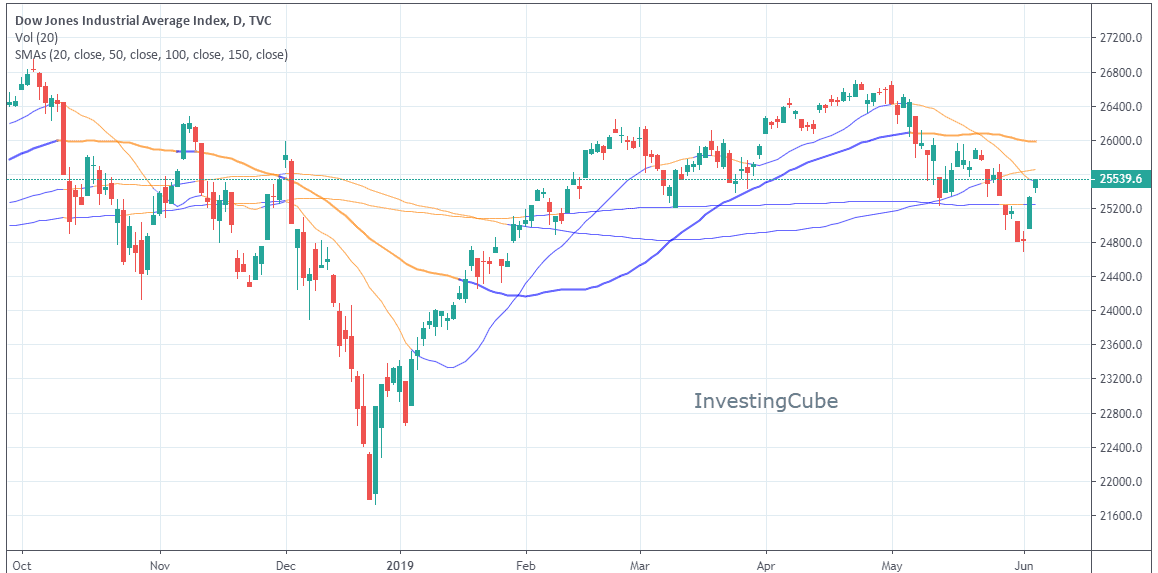

Equities in Wall Street finished higher on Wednesday, extending the rally they initiated yesterday as investors remained hopeful the Fed...

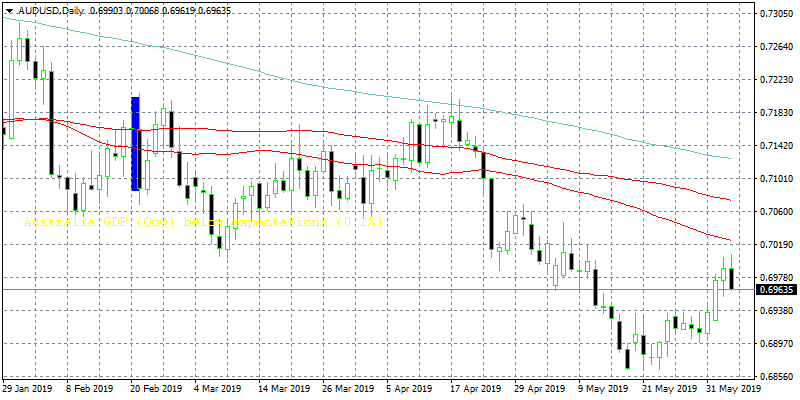

Negative tone prevails for the AUDUSD pair during US session. The Aussie had capitalized USD weakness the last three trading...

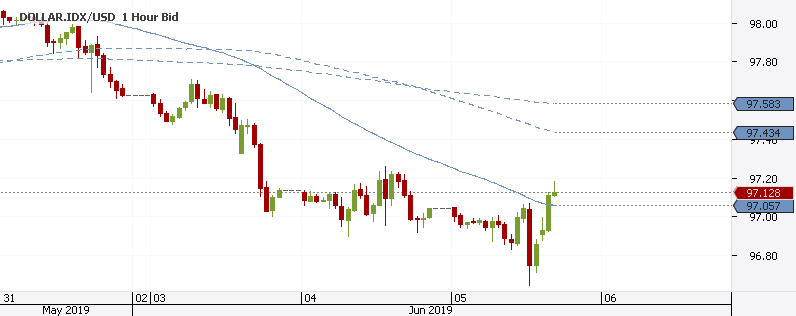

The dollar index is on a roller coaster today as it reacted with a sharp drop down to 96.70, new...

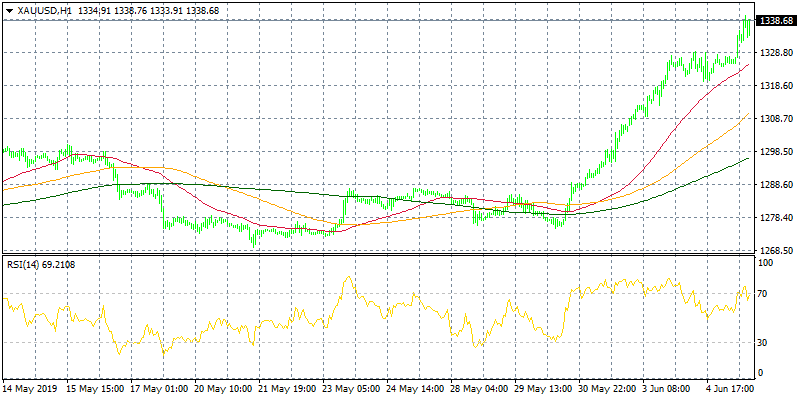

Gold hits 3 month high as investor expectations that the Fed will eventually cut interest rates in the face of...

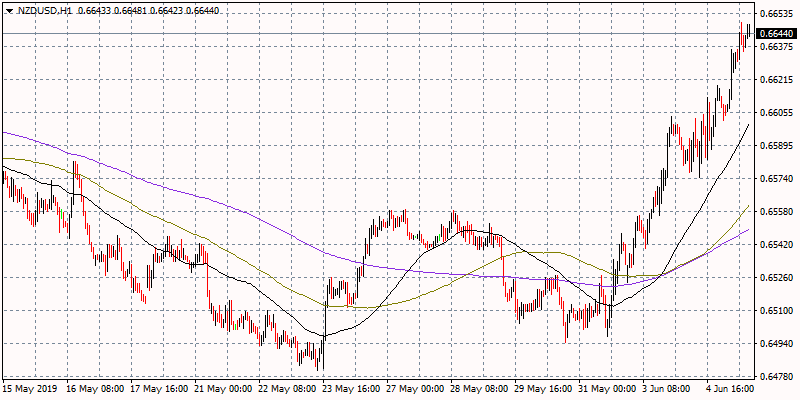

New Zealand Dollar is the winner today as it gains over 0.50 percent to 0.6640 taking advantage from USD weakness....

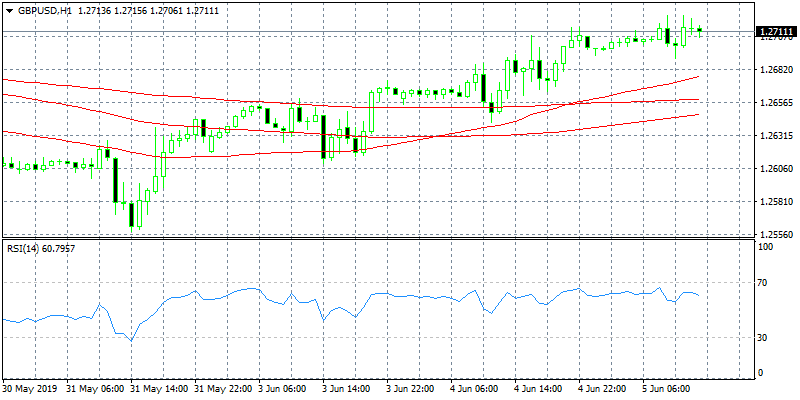

Cable is trading north making 5 days high as the rebound from previous week low below 1.26 continues, as investor...

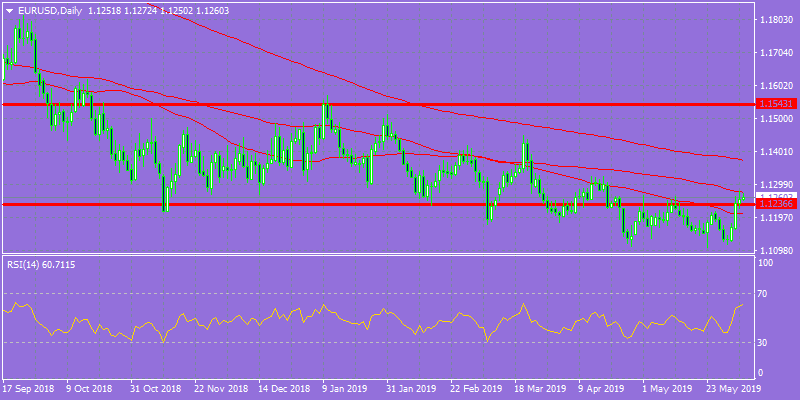

EURUSD continues higher for one more day after the pair tested YTD low last Wednesday and managed to rebound amid...