On Tuesday, the Reserve Bank of Australia decided to leave the interest rates unchanged at 1%, as the market had expected. This was enough to provide a boost to the Australian Dollar, which ended a 12-day losing streak in Asian trading today. The currency had earlier taken a huge hit after the Chinese government allowed the Yuan to drop to its lowest level in a decade following the decision of U.S. President Donald Trump to clamp a 10% tariff regime on $300 billion worth of Chinese imported goods.

The Aussie Dollar also got a boost from the Trade Balance report, which saw the country get a trade surplus of $8.04bn in June, which was above the $6.05bn the market expected and also a new record high. This was also higher than the previous trade surplus of $6.2bn recorded in May. The trade surplus figure for May was revised upwards from $5.7bn.

AUDUSD Technical Plays

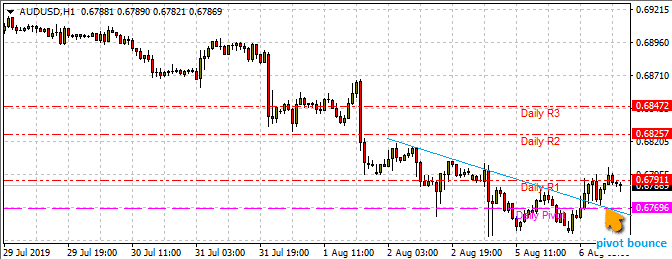

Consequently, the Australian Dollar gained 0.5% on the day and is now challenging the R1 pivot resistance area, having bounced from the broken down trendline at the central pivot support line of 0.6769.

Immediate support is seen at 0.6740, which is close to the Jan 3 low and also close to the S1 pivot for the day. A downside break will target the 0.6700 price level, while a break of the R1 resistance will target R2 pivot at 0.6825 or possibly 0.6847, which is also the 23.6% Fibonacci retracement from the swing high of 0.7205 (April 4) to the swing low of 0.67488.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.