AUDUSD trades 0.03 percent lower at 0.7001 after a number of Aussie fund management companies have exposure to financing projects related to Chinese wealth manager Noah Holdings, which said that 3.4 billion Yuan of financial products linked to entertainment-to-health care conglomerate Camsing Global’s accounts receivables from JD.com were in danger of default. Also AUDUSD feels the heat from declining iron ore futures prices that are traded in China. In the macro front, the Australia Westpac Leading Index, month over month, declined to -0.1% in June from previous reading of -0.08%. The Westpac Leading Index, month over month, came in at -0.08% for June.

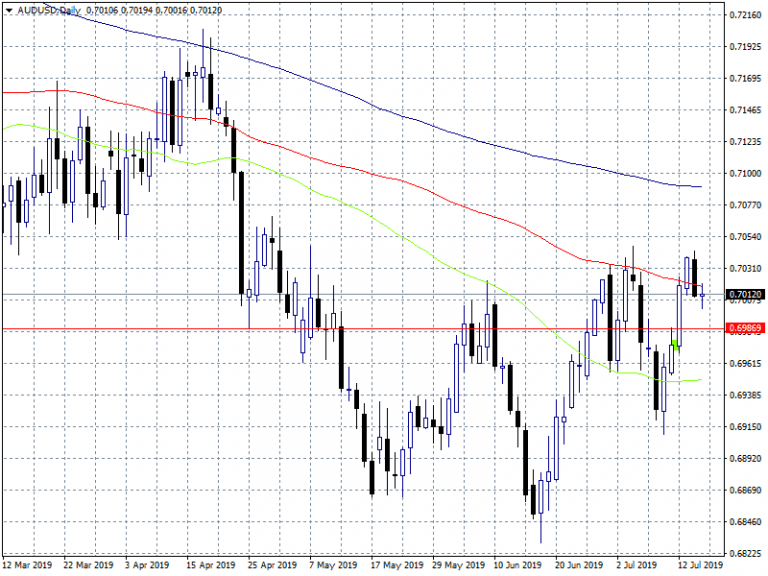

AUDUSD currently is trading below the 100 day moving average which cross at 0.7033 thus canceling the positive momentum that has build recently. On the downside first support now stands at 0.70 round figure, a level that if breached will signal the closing of long positions that started to follow the recent uptrend and some traders may enter short positions targeting the 0.6987 mark where the 200 hours moving average stands. On the upside if the pair manages to hold the 0.70 mark, bulls will target the 0.7026 resistance where the 50 hour moving average crosses and then the pair will make an attempt to 0.7046 recent high. On Thursday July 19, the Australian employment data will hit the market and drive the AUDUSD price. Traders have to be cautious as the risk event will hit the wires. As a conclusion I am expecting the positive momentum to drive the price as long as the 0.70 level holds.Don’t miss a beat! Follow us on Twitter.