AUDUSD opened higher following a busy weekend for President Trump at the G20 meeting, and his meeting with North Korea’s Kim Jong Un. However, as the dust settled, the AUDUSD traded lower as the upbeat news has triggered traders to buy US Dollars.

The outlook going forward is a bit cloudy from a technical and macroeconomic perspective. Both the Federal Reserve and Bank of Australia are anticipated to cut rates, with the expectations on the former being more aggressive in reducing interest rates than the latter. However, I can’t see how Australia, with about 21 percent of its GDP coming from exports will be able to thrive if the US and China are not doing well. The latest round of Markit PM figures from China published overnight and the US about two weeks ago, showed the world two biggest economies are slowing. As the FED and RBA both reduce interest rates amid low economic growth macroeconomic traders, don’t have a clear trading case in AUDUSD.

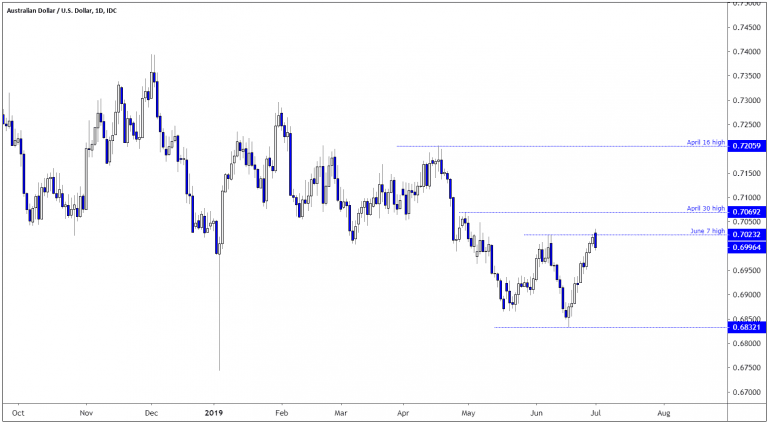

Technically, the AUDUSD outlook is also hard to interpret. On Friday and early this week the AUDUSD was trading above the June 7 high of 0.7023, but the price failed to gain any traction, and now the price is once again trading below the June 7 high, and at risk of drifting towards 0.6950 as the price gives up parts of last week’s gains. However, the price could easily trade above today’s high of 0.7035, and if it does, then, traders might target the April 30 high of 0.7069. Time will tell what will happen next, but I prefer to wait for a well-defined chart pattern to emerge before taking sides.Don’t miss a beat! Follow us on Twitter.