The AUDUSD moves in a tight correlation with the other USD pairs recently. Ever since the Fed cut the federal funds rate to the lower boundary, the USD pairs’ correlation increased because the interest rate differential leveled.

That being said, the financial markets act more like in a risk-on/risk-off mode. Regardless of some news impacting one currency or another, it is all about the USD and the way it trades. Unless a G10 central bank changes the monetary policy dramatically, the risk-on/risk-off moves are likely to continue.

Nothing From the RBA

The Reserve Bank of Australia (RBA) did not change its monetary policy in September. Moreover, it did not signal any intention to do so in the future. As such, the RBA decision was a non-event for the Aussie pair.

Even news out of the United States has an impact on the AUDUSD only when they create volatility on the stock market. The equity market is the main driver in risk-on/risk-off moves, and the AUDUSD follows it religiously.

Does it mean that the AUDUSD cannot move lower while the U.S. stock market consolidates? No. But if the AUDUSD moves lower is likely to do so on the back of a stronger USD. Or, a stronger USD will weigh on equities.

AUDUSD Technical Analysis

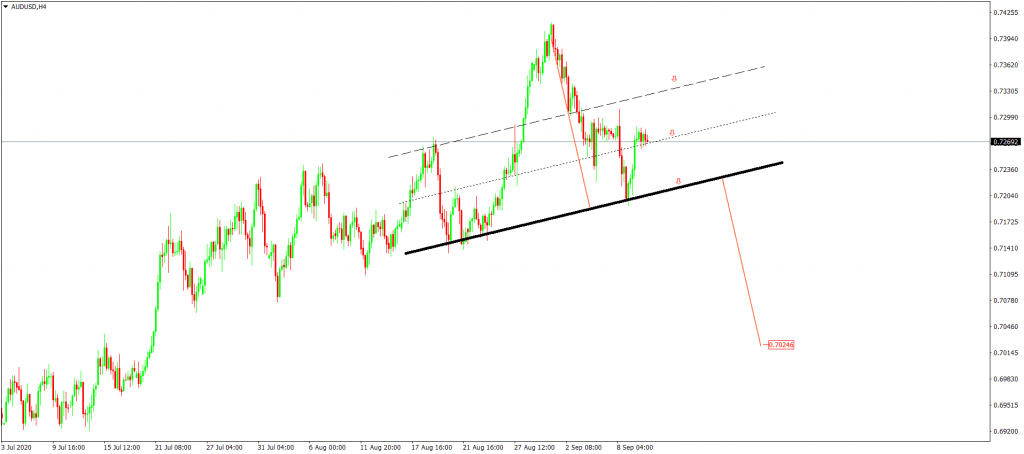

The recent price action on the Aussie pair resembles a head and shoulders pattern. With the head of the pattern already in place, the consolidation on the right shoulder offers plenty of opportunities to trade it on the short side.

First, conservative bears may want to wait for the price to reach the projected trendline before going short. Or, to wait for the price to break the main trendline before going short for the measured move.

Second, even a trade at the market will satisfy aggressive bears, as long as the reversal will not exceed the high in the head of the pattern.

As for the take profit, the measured move is good enough for an appropriate risk-reward ratio.

To learn more about head and shoulders, consider enrolling in our trading coaching program.

Don’t miss a beat! Follow us on Telegram and Twitter.

AUDUSD Price Forecast

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Mircea on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.