The AUD/NZD forex pair dropped to the lowest point since August 2 as the Australian dollar strength continued. It fell to a low of 1.1020, which was about 1.45% below the highest point on July 27th.

New Zealand PMI and FPI

The AUD to NZD exchange rate continued its downward trend on Friday after the latest New Zealand business PMI data. The data revealed that business activity in the country did relatively well in July. It rose from 50.0 in June to 52.7 in July as demand continues rising.

Meanwhile, additional data from New Zealand revealed that the country’s food price index (FPI) rose from 1.2% in June to 2.1% in July. These numbers came as the Reserve Bank of New Zealand (RBNZ) prepared for next week’s monetary policy meeting.

Economists expect that the RBNZ will deliver another rate hike in a bid to fight the soaring inflation. Data published in July showed that the country’s consumer price index surged to a 32-year high of 7.3% in June. At the same time, the unemployment rate dropped to 3.3% in the June quarter. As such, the bank has the justification it needs to deliver another rate hike.

AUD/NZD forecast

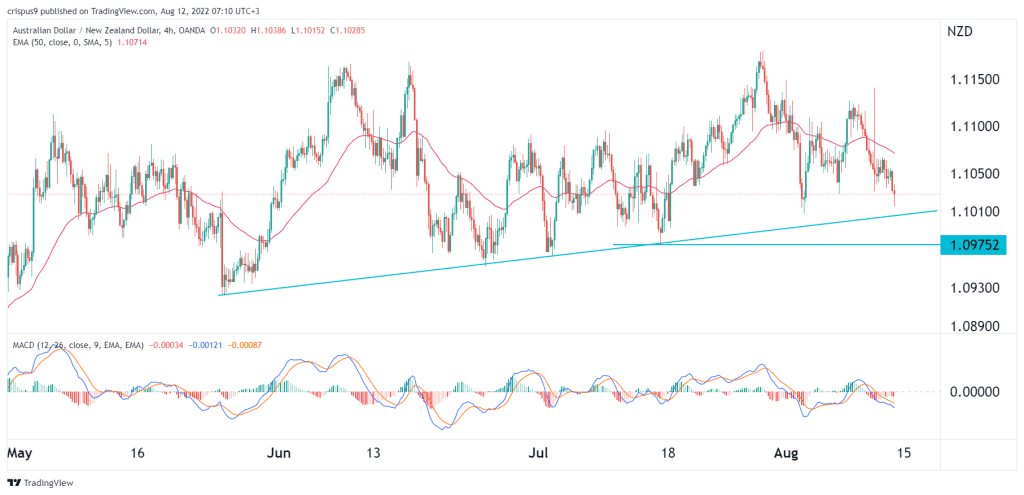

The four-hour chart shows that the AUD to NZD price has been in a strong bearish trend in the past few days. Along the way, the pair managed to move below the 25-day and 50-day moving averages. It has also moved slightly above the ascending trendline that is shown in blue while the MACD has moved below the neutral point.

The pair will likely continue falling as sellers target the next key support at 1.0975, which was the lowest point on July 15th. A move above the resistance at 1.1050 will invalidate the bearish view.