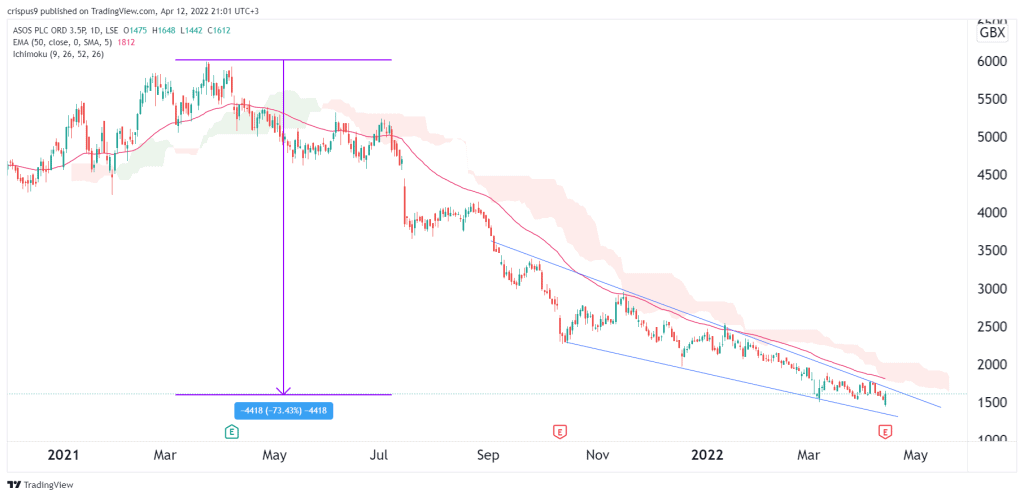

The Asos share price darted higher on Tuesday after the company published its interim results for the six months to February of this year. The stock jumped to a high of 1,612p, slightly above the year-to-date low of 1,468p. But, like Boohoo and Next PLC, Asos shares have slumped by over 73% below the highest level in 2021. As a result, the fashion company is now valued at 1.6 billion pounds.

Asos is a leading fashion company that sells most of its products in the UK. The firm uses an online-first model, although it has several stores in places like London. The company has been hit hard in the past few months as the cost of cotton and other inputs has jumped sharply. It is also facing significant costs as the logistics nightmare continues. Most importantly, the company faces rising competition from a company like Shein, which is now valued at over $100 billion.

On Tuesday, Asos said that its total sales in the period rose by 4% to 2 billion pounds while its gross margin fell by 190 basis points to 43.1%. On the other hand, its capital expenditure rose by 43% to 85.5 million pounds. The growth of its capex was mostly because of the ongoing building of its fulfilment center. Another highlight was that the firm’s operating loss was 4.4 million pounds after it recorded a 109 million pound profit.

So, is Asos too cheap to invest in? In my view, Asos seems like a cheap and interesting turnaround story. The firm still has a strong market share in the UK, and its stock has moved to the lowest level since April 2020. While this bump will likely fade, I think that the firm offers better returns in the future.

Asos share price forecast

The daily chart shows that the Asos stock price has been in a strong bearish trend in the past few months. Along the way, the stock has formed what looks like a falling wedge pattern. It is also slightly below the Ichimoku cloud and all moving averages.

Therefore, because of the falling wedge pattern, there is a likelihood that the stock will soon stage a strong comeback. If this happens, the next key resistance level to watch will be at 2,500p.