The AMGO share price forecasts remain neutral as the stock of Amigo Holdings PLC continues to record significant struggles in mounting any kind of upside move. Despite closing higher in the last two trading sessions, the stock remains range-bound as it witnesses choppy intraday sessions.

The key fundamental trigger remains the situation with the wind-down schemes. Recall that in March, a High Court granted the company approval for a call of schemes meeting. This meeting led to the development of proposals to pay off creditors, approved by the Financial Conduct Authority (FCA), the UK’s financial watchdog. Preliminary sanction hearings were skipped by this approval, paving the way for a creditors’ vote on a new business scheme or a wind-down scheme.

On Friday, the company got the reprieve it had been waiting for, as most creditors voted for a new business scheme, which brings the company closer to resuming its lending business. At least 88% of creditors voted in favour of a new business scheme.

A court hearing to sanction the vote will hold on 23-24 May. As a result, the company intends to request a share trading suspension from 23 May. Future AMGO share price forecasts will depend on the outcome of the court sanction hearings. Trading for the day opens about an hour from now.

AMGO Share Price Forecast

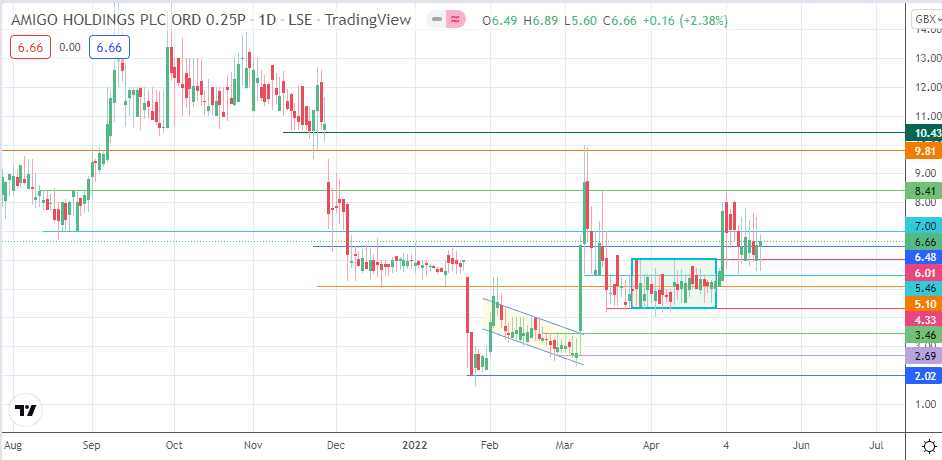

The AMGO share price is trading in very tight ranges. The price action candle is sitting on the 6.48 support level (10 December 2021 and 18 January 2022 highs). A break of this level meets immediate resistance at the 7.00 psychological price mark and the site of the 3 December 2021 low and 11/16 March 2022 highs.

If the bulls can uncap this resistance, there will be clear skies to approach the 8.41 resistance mark (15 March and 4 May highs). Additional targets to the upside are seen at 9.81 (3 September 2021 and 8 March 2022 highs) and 10.43 (15-22 November 2021 lows).

Conversely, the bullish outlook is negated if the price action breaks down the support at 6.48. This action will make 6.01 immediately available as the next support target. If the decline continues below this price mark, which is the former ceiling of the completed rectangle, the 5.46 and 5.01 (14 January and 29 April lows) support levels enter the picture.

The bulls must degrade these support levels before the former floor of the rectangle at 4.33 (16 March and 6 April lows, among others) enters the mix. 3.46 and 2.69 (7 March low) round off immediate pivots below this floor to the south.

AMGO: Daily Chart