The AMC stock price has been feeling the pain lately even as the company continues its expansion in the United States. The stock has dropped to about $15.50, the lowest level since March 21st. It has dropped by more than 54% from the highest point on March 29th. This drop is about 80% from its highest level in 2021, bringing its total market cap to about $8.4 billion.

AMC has used the Covid-19 pandemic to grow its business by acquiring distressed locations. This month, the company added seven new Connecticut and New York locations. The firm’s CEO has expressed hope that the company will continue adding new locations in the coming months. It is using some of the cash it raised last year to implement these acquisitions.

However, like most companies, the AMC stock price has crashed hard in the past few months as worries about the industry’s recovery remain. Most importantly, some investors are worried about the company’s total debt. The firm has about $1.59 billion in total cash and over $10.75 billion in debt. Its net debt is about $1.59 billion. Therefore, the company could struggle to pay back these funds as interest rates rise.

AMC’s performance also mirrors that of other leading meme stocks. For example, the GameStop stock price has dropped by more than 16% in the past 30 days. Similarly, Clover Health stock price has dropped by 23% in this period. In addition, ContextLogic’s WISH stock has fallen by over 25%, while Blackberry has nosedived by 22%.

The next key catalyst for the AMC share price will be the upcoming earnings. Analysts expect that the company’s revenue rose to $741 million while its loss per share jumped to 63 cents.

AMC stock price forecast

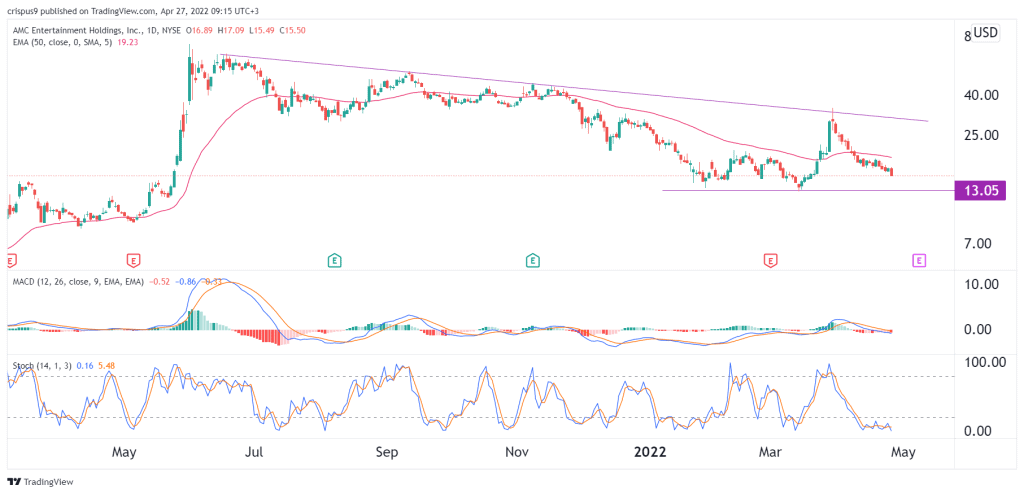

On the 1D chart, we see that the AMC stock price has been in a bearish trend in the past few weeks. As a result, the stock has fallen below the 50-day EMA while the Stochastic oscillator has dropped to the oversold level. In addition, the MACD oscillator has moved to the neutral level.

Therefore, the path of the least resistance for the stock is lower, with the next key support level at $13.05. This is an important level since it was the lowest level on March 15th. The key stop for this view will be at $19.18.