The AMC stock forecasts that foresee a potential for recovery got some support on Thursday, but this may not be enough to keep the stock from falling further unless the bulls exert more action to overcome the bears. Before Thursday, the AMC stock had fallen for four straight days as the markets shifted away from risk-taking to risk-aversion.

The stock has opened higher, as have many of the WallStreetBet meme stocks, jumping 8.93% as traders look for bargain deals on the US markets this Friday. GameStop and Robinhood also saw significant upticks on Friday.

The rise in AMC shares follows a period of decline that was triggered after the company’s last earnings report showed vastly improved revenues in a still unprofitable earnings environment and a rising debt profile. The company’s losses were down from $567m in the same period a year earlier to $337m. Revenues jumped nearly five-fold. With its theatres now opening once more, the company hopes to put behind it its recent legal losses and push itself back into a profitable financial position.

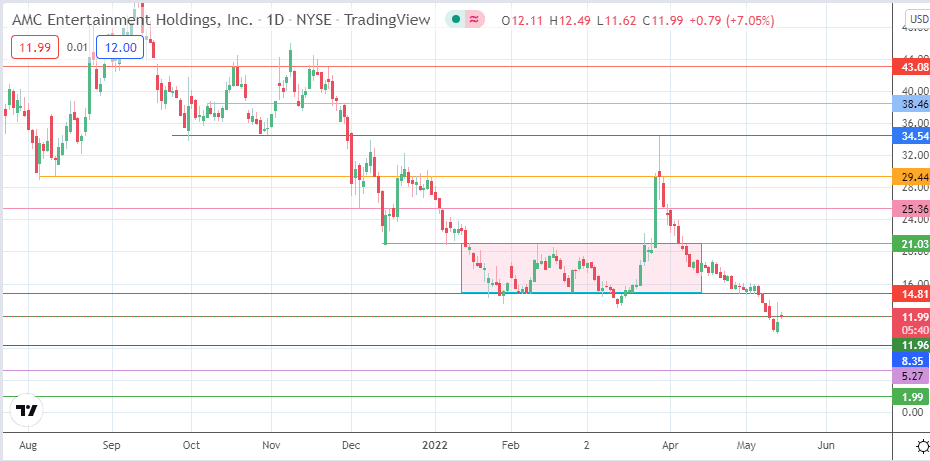

Technically speaking, Thursday’s price action candle indicates there is still life left in the bears. However, the intraday rejection of the upside violation of 11.96 kept the candle’s closing price beneath that resistance. Therefore, any bullish AMC stock forecasts have to secure a foundation from the breach of this resistance to the upside with a suitable price/time confirmation filter.

AMC Stock Forecast

Thursday’s 8.3% uptick failed to close above the 11.96 resistance. The bulls must uncap this barrier with a bullish outside day candle to overcome the potential for a drop. Only when this is achieved can the price activity have a chance to attain the 14.81 barrier (6 May 2022 low and floor of completed rectangle pattern). The ceiling of the former rectangle remains a barrier to the north at 21.03 before the 5 January 2022/1 April 2022 highs at 25.36 form an additional northbound target.

On the flip side, a renewal of the selloff following rejection at the 11.96 resistance brings in 8.35 (12 April 2021 low) as the initial downside target. If the bears overcome this support level, 5.27 (10 February 2021 low) becomes the next pivot in line. Finally, an additional downside target resides at 1.99 (3 November 2020 and 6 January 2021) before new all-time lows emerge if the price deterioration continues.

AMC: Daily Chart