The Amazon stock price has recoiled ahead of the upcoming quarterly earnings report. AMZN shares are trading at $3,110, about 17% below its highest level in 2021 and about 16% above its lowest level this year. This year, it has crashed by about 10%, making it the third-best performing FAANG stock after Apple and Alphabet.

Why has AMZN lagged?

There are several two main why the Amazon stock price has crashed. First, there are concerns about the company’s retail segment as inflation jumps. Most sellers have been forced to hike prices to protect their thin margins. Still, analysts expect that the company’s business will hold steady, considering that its platform provides some of the best prices. Indeed, data published this week showed that the country’retail sales did well in March.

Second, there are concerns about the company’s cloud business. While demand has risen sharply in the past few months, analysts expect this momentum to keep rising. At the same time, while the company has a leading market share in the sector, other firms like Alphabet and IBM are gaining market share. This week, an analyst noted that Google had launched notable products during its recent Data Cloud Summit.

However, one catalyst could push the Amazon stock price higher. With Apple’s recent update, many advertisers are shifting dollars away from Facebook to other platforms. As a result, Amazon is well-positioned to be a leading player in the sector. For example, it has grown the ad business from a small segment to one that generated over $31 billion in 2021. This trend will likely continue in the coming years.

Amazon stock price forecast

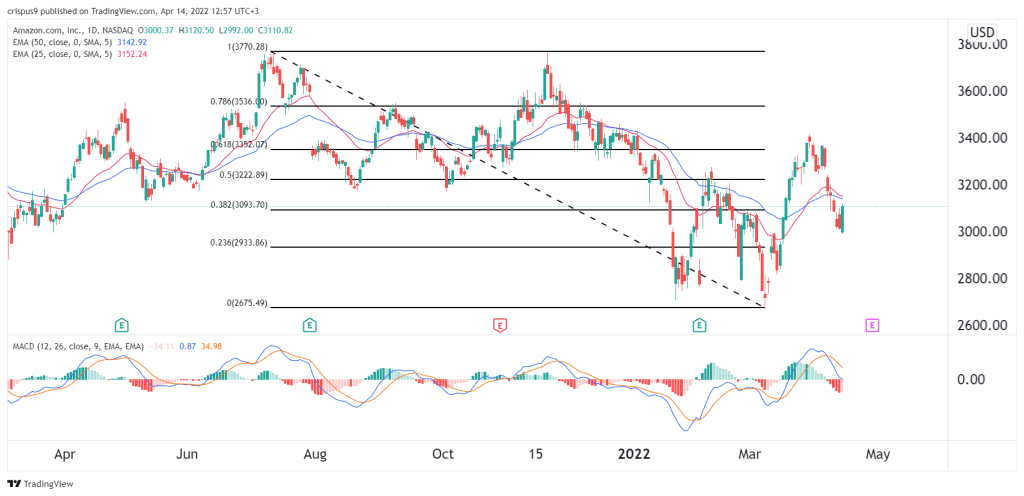

The daily chart shows that the Amazon share price has been ugly this year. It is slightly above the 38.2% Fibonacci retracement level and below the 25-day and 50-day moving averages. The MACD, on the other hand, has formed a bearish crossover. Therefore, there is a likelihood that the stock will bounce back now that it has formed a bullish engulfing pattern. If this happens, the next resistance will be at $3,200.